Project Overview

AlternativeLending.io is a digital platform dedicated to tracking innovation, strategy, and regulatory shifts in the non-bank commercial finance space. The site features original content on fintech and lending, as well as a premium directory of over 1,000 lending companies that cater to small businesses. The platform is designed for professionals in finance, fintech, and legal industries looking to stay ahead of emerging trends and discover new lending partners.

As the lead contributor, I owned the end-to-end development and design of the platform. My work spanned UI/UX design, branding, and full product development—including subscription management, content access gating, and email marketing systems to support user acquisition and engagement.

Services Provided

Tools Used

Problem & Goals

The project aimed to address a gap in accessible, centralized information on non-bank commercial lending. Most existing platforms were either outdated, cluttered, or failed to offer a mobile-first experience. The team behind AlternativeLending.io wanted to bring clarity, usability, and structure to a complex industry.

Initial Goals for MVP (Phase 1):

-

Launch a freemium product aggregating relevant industry news to build early traction.

-

Design a clean, intuitive, mobile-responsive interface that made content easy to browse and consume.

-

Develop a weekly digital newsletter delivering curated insights and premium content to drive engagement and subscriptions.

Phase 2 Goals:

-

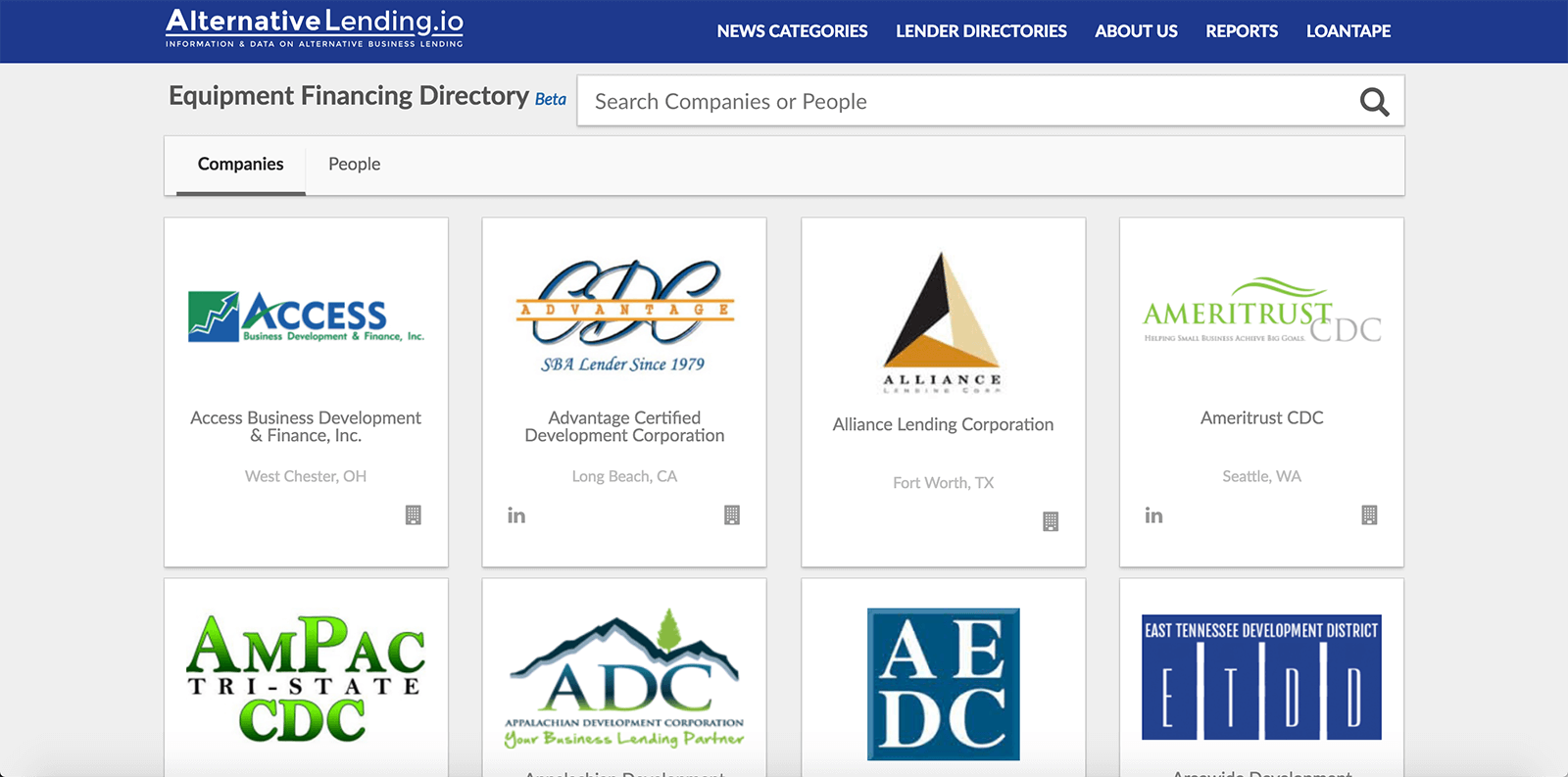

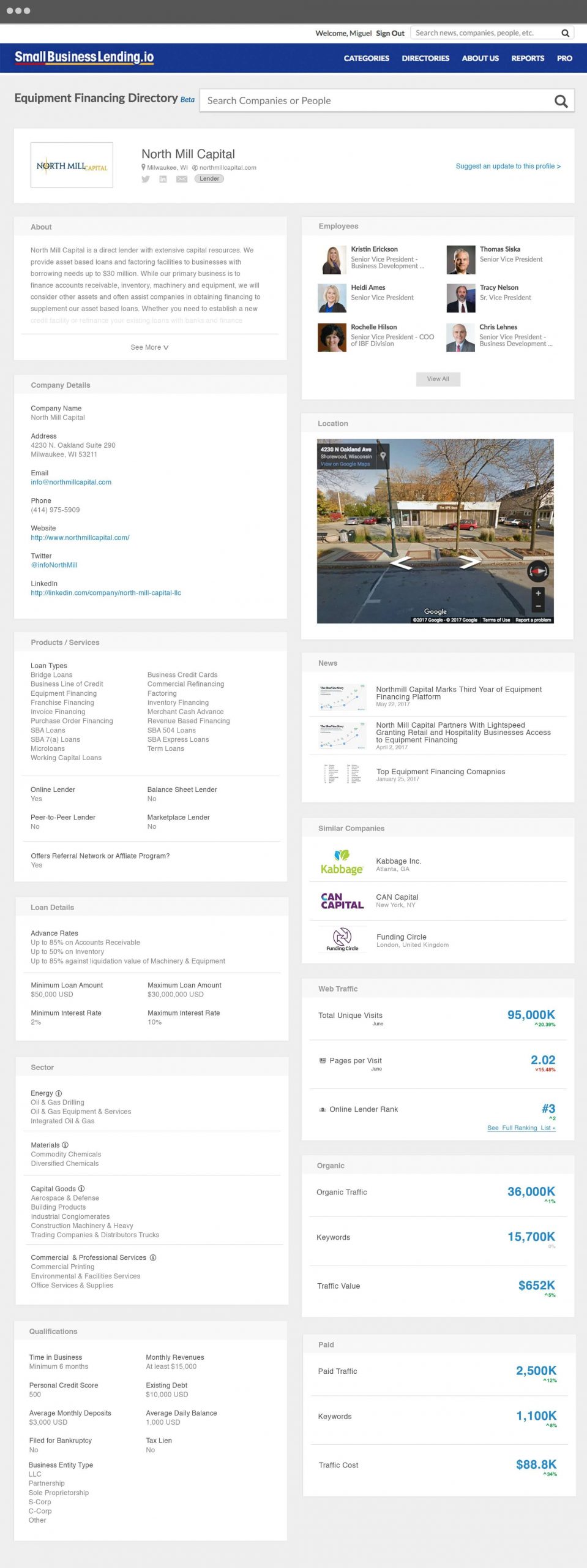

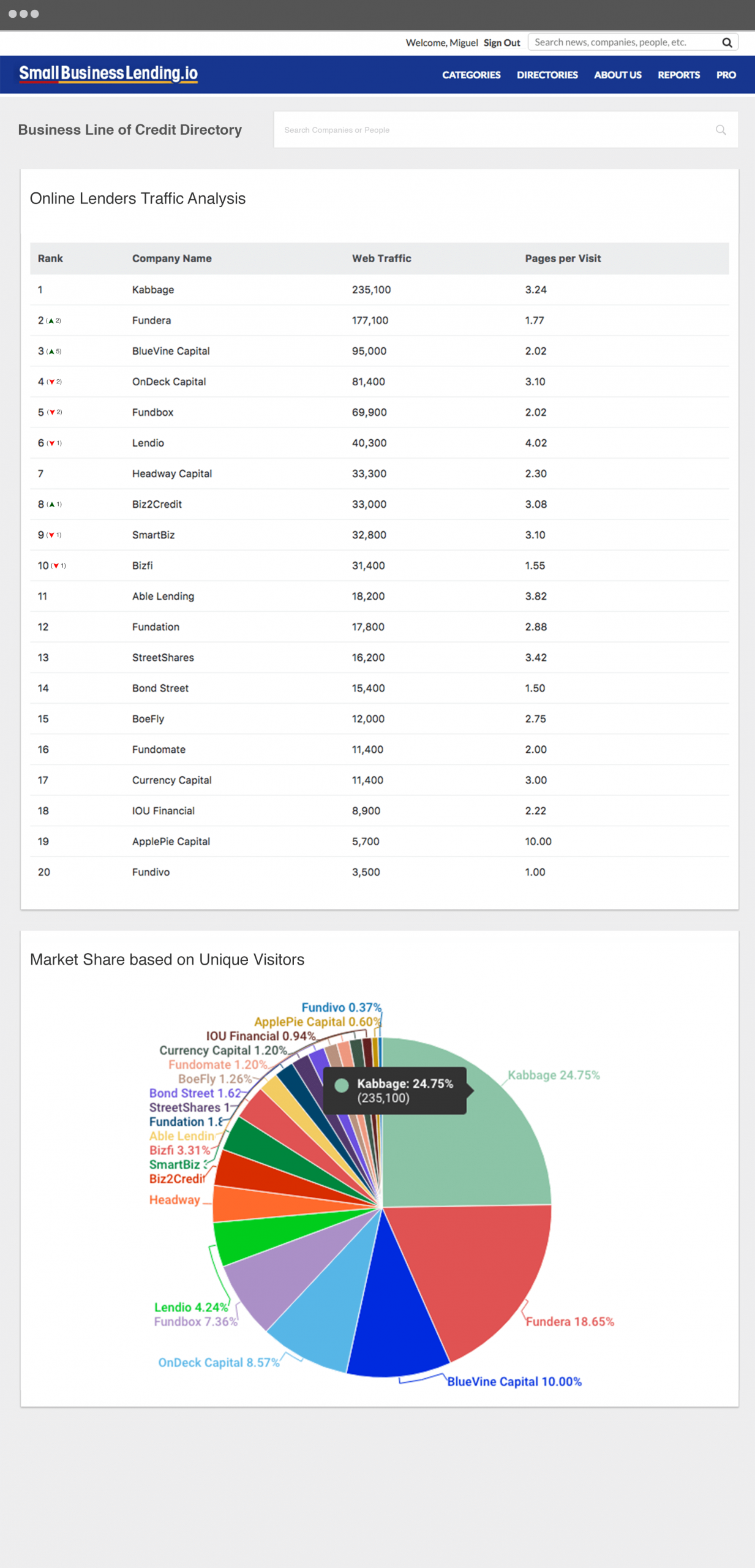

Launch a robust lending directory of 1,000+ companies, accessible only to subscribers.

-

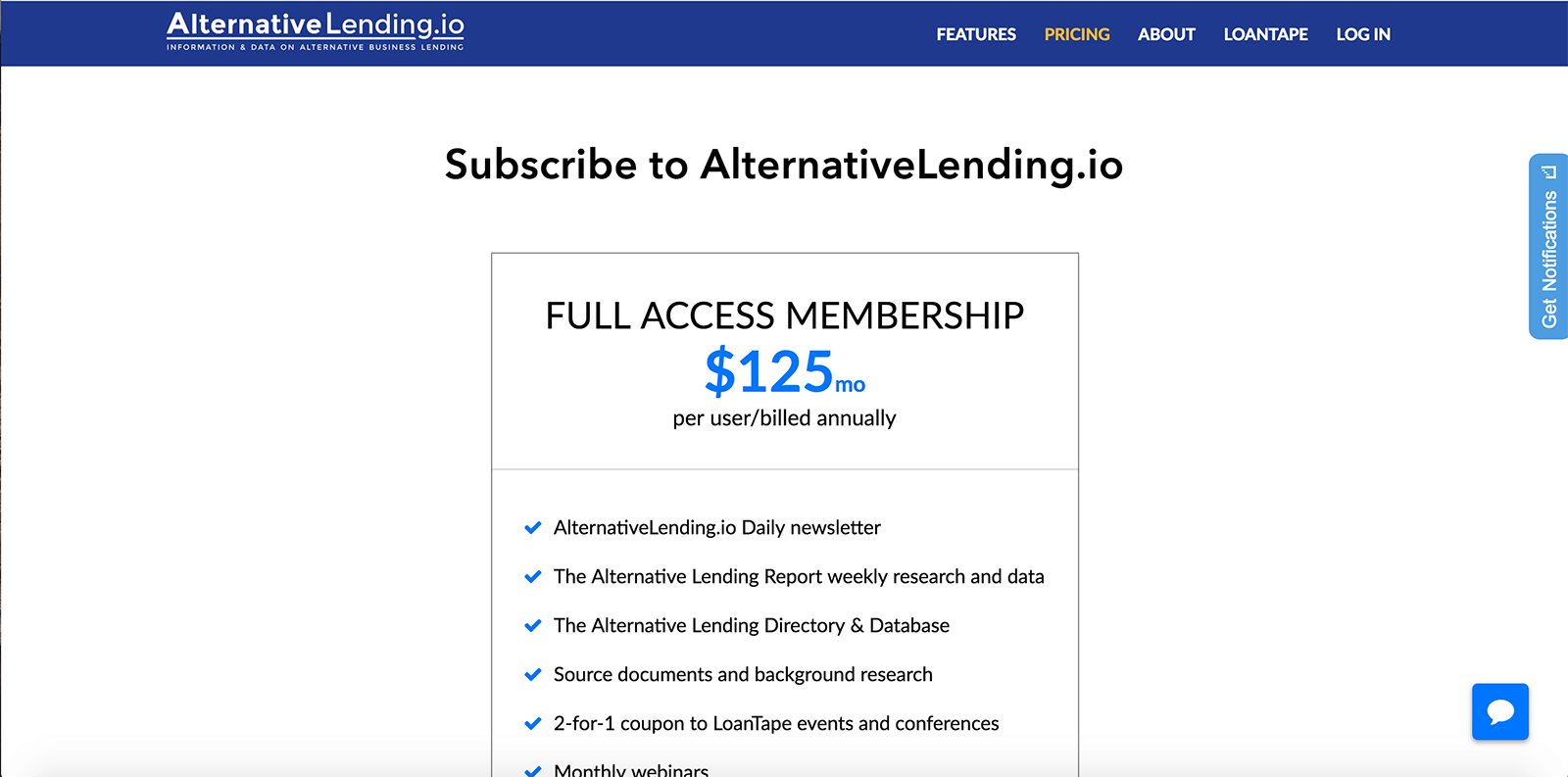

Grow the subscriber base and explore product-market fit by testing pricing, messaging, and feature sets.

-

Continuously improve user experience through data-informed iterations and customer feedback.

My Role & Contributions

As the sole product contributor on this project, I led the design and development of AlternativeLending.io from the ground up. My focus was on building a user-centric, scalable foundation while also launching growth and monetization efforts in parallel.

Key Contributions:

-

Product Design: Designed a clean, modern UI Design optimized for both desktop and mobile users. Prioritized UX by simplicity, clarity, and intuitive navigation to enhance engagement and retention.

-

Branding & Logo Design: Created a brand identity that reflects trust, professionalism, and innovation—critical for a finance-forward audience.

-

Product Development: Built the initial freemium product experience, integrated a CMS for content delivery, implemented gated access for premium content, and architected the upcoming directory feature.

-

Email Marketing: Developed and deployed a weekly newsletter strategy that delivered premium content to subscribers, helping convert free users into paying members.

-

Subscription Management: Set up and managed the full subscription flow, including account creation, access levels, and payment integration.

-

Product Marketing: Supported early growth efforts by crafting messaging, onboarding flows, and feature announcements to drive adoption and feedback.

Outcome & Impact

AlternativeLending.io launched successfully with a lean MVP that began to attract a targeted, high-intent audience interested in non-bank lending innovation. The clean, mobile-optimized design and curated content experience were well-received by early users, validating the need for a fresh take in this niche space.

Early Wins:

-

The freemium model and weekly newsletter quickly gained initial subscribers, providing a channel for regular engagement and feedback.

-

Early adopters praised the clarity of the user interface and the value of aggregated news, reinforcing the need for accessible, centralized content in the space.

-

Email open rates and click-through rates exceeded industry averages, indicating high relevance and interest in the premium content offering.

-

Development of the premium directory, driven by insights from early user behavior and evolving feature requests.

These results helped confirm the product’s direction and laid a strong foundation for future iterations, including more advanced content filtering, expanded lender profiles, and targeted marketing strategies.